DENMARK-NIGERIA BUSINESS FORUM is a non-profit influential network. The purpose of Denmark-Nigeria Business Forum is to promote and facilitate commercial ties between Denmark and Nigeria . DNBF promotes Danish and Nigeria interests and assists share contacts among companies and individuals with commercial interests in Nigeria and to improve the framework conditions for the benefit of our members.

Want to learn more?

Denmark-Nigeria Business Forum was founded by a consortium of Danish investors and companies who after careful deliberations elected Stig Nielsen The Chairman of The Board of DNBF in 2021, and Samuel Eze Secretary- General of DNBF.

DNBF is an Independent, non-profit network organisation. It was founded by a consortium of Danish entrepreneurs and companies doing business in Nigeria with the sole aim of enhancing business cooperation between Denmark and Nigeria .

Our goal is to help facilitate information sharing between our members and to open doors of business opportunities for economic growth that would otherwise be difficult without our participation.

DNBF provides the frame work and channels to harmonise cooperation for business establishment in Nigeria.Business intelligence, market analysis and human capital development.

SEMINAR AT NIGERIA PAVILION IN DENMARK

We organise round table diplomatic meetings with Denmark and Nigeria stakeholders , to facilitate for our members key interests .

If you wish to engage in business in Nigeria as in sub - Sahara Africa in general setting up a solid value chain are necessary in order to do successfull business in Nigeria

The Danish Trade Council is a governmental export and investment promotion organization under the Ministry of Foreign Affairs of Denmark. The organisation comprises all governmental activities designed to promote Danish export and foreign investment in Denmark under one roof. In Nigeria, the Trade Council is based in Lagos.

The One Stop Investment Centre, provides investment facilitation services, reduce time required to process regulatory approvals and permits and assist with information and requirements from incorporation to expansion.

COUNTRY FACTS

Indicators NG

Inflation rate (January ’23, %) 21.82 GDP (Q4 ’22, %) 3.51 Gross Official Reserves (02 March ’23, USD bn) 36.7

UK Brent (10 March ’23, USD) 82.3

FGN bond yields (10 March '23, %)

14.20% 13.98% 12.15% 12.40%

Mar-24 Feb-28 Jul-34 Mar-36

6.58 13.61 14.65 14.68

T-bill yields (10 March '23, %)

27- 08- 07- 07-

Apr-23 Jun-23 Sep-23 Dec-23

2.87 1.78 4.50 4.38

Retail growth requires:

In conjunction with The Royal Danish embassy in Abuja we offer travel advisory and security services while in Nigeria. We understand the people, the terrain and culture of the people which has made DNBF have ACCESS.

DNBF enhance networking through seminars, workshops and we encourage our members to make use of this open windows to harvest opportunities via our executive channels.

I would love to welcome you to DNBF, we are your partner. We help facilitate connections to make our members do their business with ease. DNBF is a network of professionals, experts and business executives who break boundaries with excellence. I am profoundly delighted to be a part of their success.

" DNBF is built on mutual friendship of ideas and knowledge sharing."

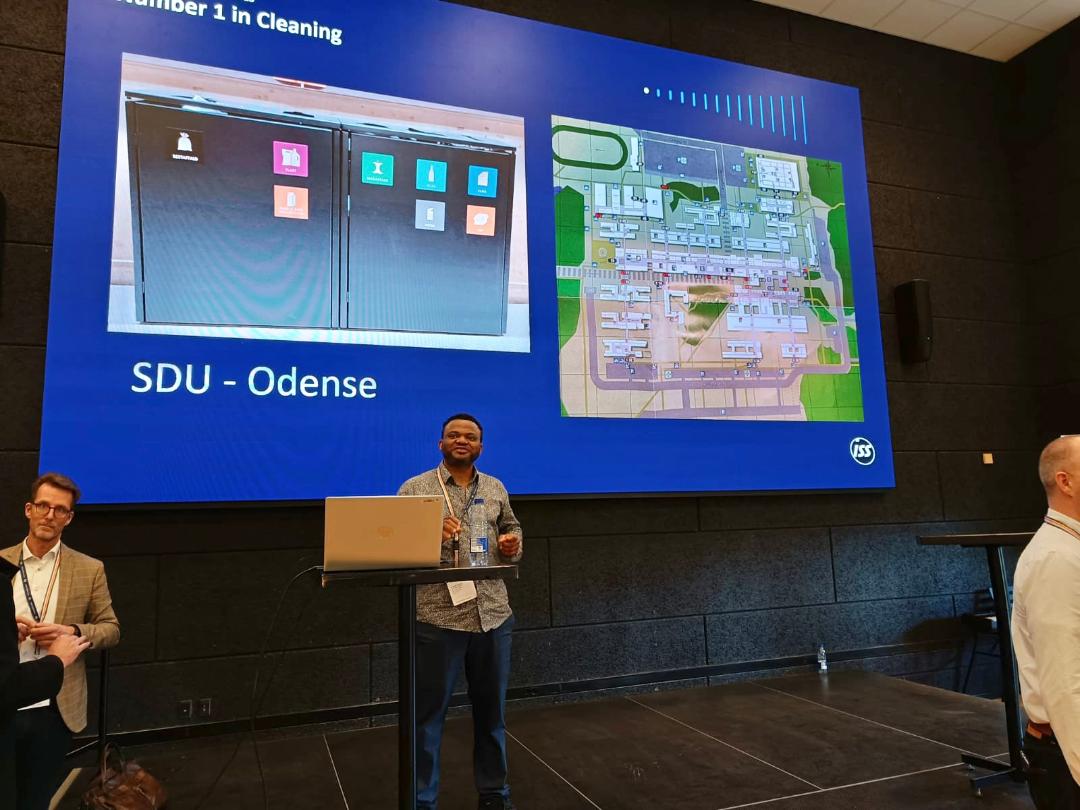

Samuel is a Danish-Nigerian technocrat before his election in DNBF. He is country representative in Denmark for Nigeria investment Group since December 2009. Among other things Samuel has worked for ISS FACILITY SERVICE A/S as a customer service manager and Business development manager for SCANDINAVIAN BABY PRODUCTS , which exports baby care products to African countries including Nigeria. Today, he is the Founder of LAGOS BIZ LTD that offers business advice and support about legal services to mostly Scandinavian companies regarding market entry, company establishments and operations in Nigeria.

Please fill out the membership application form below.

All applications to Denmark-Nigeria Business Forum will be subject to review.

DNBF participated at the just concluded Investment conference for Africa 2023, Odense Denmark

Mørkhøjvej 113

DK-2860

Danmark